Price Action Trading Course by Dhaval Malvania 90 days to get-start disciplined trading Duration 3 Months (2 hours per day) Monday To Friday For Working Professional Time for Class is adjusted. for Evening batch. [note: try to get in class in morning session in live market to build psychology for trading.] Delivery : Online [By Cisco Webex, google meet , zoom ofline class as well] Investment – Retail price : Rs 15,000 Our Referral Customers : Rs 15,000 Next Batch starting from 15th May 2023 JOIN TODAY : PART 1 Overview of financial markets Oppor tunities available in the world of trading Advantages of trading Why a majority of traders fail? What it takes to become a successful trader? How to kick-start your trading journey on the right note? Understanding Technical Analysis What is technical analysis? Advantages and limitations of technical analysis Different forms of technical analysis Important things to consider while usi...

Why Cipla perform low in share market since few years?

Cipla is an anytime good company to invest but you should have the patience to hold. If you see the past one-year record the price range is 900–1000 so it's not moving as per the user perspective. Try to buy in a deep correction. The stock has the potential to surge above 950 and move down below 890.

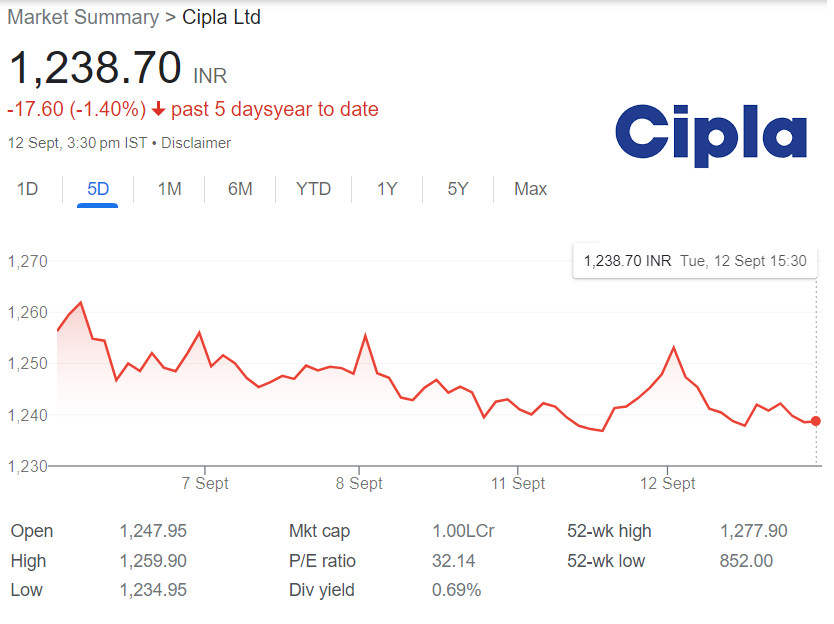

Will Cipla share price decrease?

The current data for Cipla stock shows that the price is ₹1240.7. There has been a percent change of -0.35, indicating a slight decrease in value. The net change is -4.35, suggesting a decrease of ₹4.35 in the stock price. Overall, this data indicates a small decline in the value of Cipla stock.

Can I invest in Cipla?

Direct investment: You can buy Cipla (CIPLA) shares by opening a Demat account with Zerodha. Indirect investment: The indirect method involves investing through ETFs and Mutual Funds that offer exposure to Cipla (CIPLA) shares.

Is Cipla a good stock to buy for long term?

Cipla is an anytime good company to invest but you should have the patience to hold. If you see the past one-year record the price range is 900–1000 so it's not moving as per the user perspective. Try to buy in a deep correction. The stock has the potential to surge above 950 and move down below 890.

Comments

Post a Comment