Price Action Trading Course by Dhaval Malvania 90 days to get-start disciplined trading Duration 3 Months (2 hours per day) Monday To Friday For Working Professional Time for Class is adjusted. for Evening batch. [note: try to get in class in morning session in live market to build psychology for trading.] Delivery : Online [By Cisco Webex, google meet , zoom ofline class as well] Investment – Retail price : Rs 15,000 Our Referral Customers : Rs 15,000 Next Batch starting from 15th May 2023 JOIN TODAY : PART 1 Overview of financial markets Oppor tunities available in the world of trading Advantages of trading Why a majority of traders fail? What it takes to become a successful trader? How to kick-start your trading journey on the right note? Understanding Technical Analysis What is technical analysis? Advantages and limitations of technical analysis Different forms of technical analysis Important things to consider while usi...

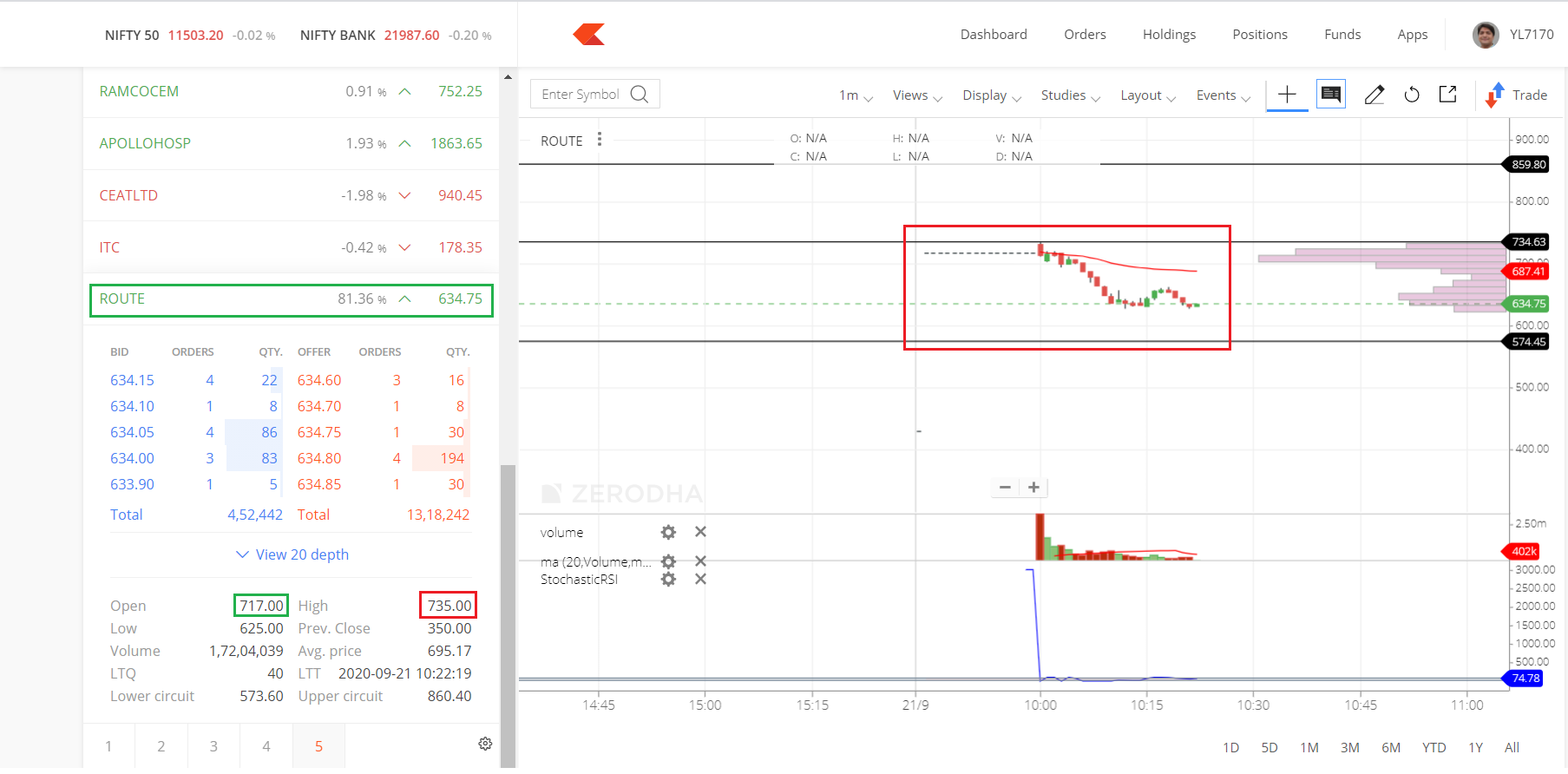

ROUTE MOBILE IPO GMP PRICE

Levels for ROUTE MOBILE listing price range :

350 , 403, 436, 463, 489, 527, 575, 714

updated chart for ROUTE MOBILE on 21-09-2020 10:24 a.m.

Route Mobile Ltd IPO (Route Mobile IPO) Detail

Company Promoters:

Sandipkumar Gupta and Rajdipkumar Gupta are the promoters of the company.

Company Financials:

| Particulars | For the year/period ended (₹ in Million) | ||||

|---|---|---|---|---|---|

| 30-June-20 | 31-Mar-20 | 31-Mar-19 | 31-Mar-18 | ||

| Total Assets | 6,348.31 | 6,265.48 | 5,057.81 | 4,473.66 | |

| Total Revenue | 3,122.95 | 9,681.02 | 8,523.77 | 5,094.85 | |

| Profit After Tax | 269.34 | 691.02 | 545.32 | 466.77 | |

Objects of the ROUTE MOBILE IPO Issue:

The company proposes to utilise the Net Proceeds towards funding the following objects:

1. Repayment or pre-payment, in full or part, of certain borrowings of our Company;

2. Acquisitions and other strategic initiatives;

3. Purchase of office premises in Mumbai; and

4. General corporate purposes.

Route Mobile IPO Details

| IPO Date | Sep 9, 2020 - Sep 11, 2020 |

| Issue Type | Book Built Issue IPO |

| Issue Size | 17,391,303 Eq Shares of ₹10 (aggregating up to ₹600.00 Cr) |

| Fresh Issue | [.] Eq Shares of ₹10 (aggregating up to ₹240.00 Cr) |

| Offer for Sale | [.] Eq Shares of ₹10 (aggregating up to ₹360.00 Cr) |

| Face Value | ₹10 per equity share |

| IPO Price | ₹345 to ₹350 per equity share |

| Market Lot | 40 Shares |

| Min Order Quantity | 40 Shares |

| Listing At | BSE, NSE |

Route Mobile IPO Tentative Date / Timetable

| Bid/Offer Opens On | Sep 9, 2020 |

| Bid/Offer Closes On | Sep 11, 2020 |

| Finalisation of Basis of Allotment | Sep 16, 2020 |

| Initiation of Refunds | Sep 17, 2020 |

| Credit of Shares to Demat Acct | Sep 18, 2020 |

| IPO Shares Listing Date | Sep 21, 2020 |

Route Mobile IPO Lot Size and Price (Retail)

| Application | Lots | Shares | Amount (Cut-off) |

|---|---|---|---|

| Minimum | 1 | 40 | ₹14,000 |

| Maximum | 14 | 560 | ₹196,000 |

Route Mobile IPO Promoter Holding

| Pre Issue Share Holding | 96% |

| Post Issue Share Holding | 66.33% |

Route Mobile IPO Offer Size by Investor Category

The Percentage of Offer Size available for Allotment/allocation:

- QIBs: 50% (₹300 Cr)

- Non-Institutional Investors: 15% (₹90 Cr)

- Retail Individual Investors: 35% (₹210 Cr)

Risks to Investors in Route Mobile IPO

- Operate in a highly evolving market.

- Greater dependency on 3rd parties mobile network operations.

- Revenues depend on a limited number of clients.

- Rely on 3rd party technology systems and infrastructure to provide services and solutions to clients.

- The risk from potential claims resulting from the client's misuse of its platform to send unauthorized text messages in violation of TRAI regulations.

Route Mobile IPO Subscription Status (Bidding Detail)

No. of Times Issue Subscribed (BSE + NSE) | ||||

|---|---|---|---|---|

As on Date & Time | QIB | NII | RII | Total |

Shares Offered | 3,478,259 | 2,608,696 | 6,086,957 | 12,173,912 |

Sep 11, 2020 17:00 | 89.76x | 192.81x | 12.67x | 73.30x |

Comments

Post a Comment