Price Action Trading Course by Dhaval Malvania 90 days to get-start disciplined trading Duration 3 Months (2 hours per day) Monday To Friday For Working Professional Time for Class is adjusted. for Evening batch. [note: try to get in class in morning session in live market to build psychology for trading.] Delivery : Online [By Cisco Webex, google meet , zoom ofline class as well] Investment – Retail price : Rs 15,000 Our Referral Customers : Rs 15,000 Next Batch starting from 15th May 2023 JOIN TODAY : PART 1 Overview of financial markets Oppor tunities available in the world of trading Advantages of trading Why a majority of traders fail? What it takes to become a successful trader? How to kick-start your trading journey on the right note? Understanding Technical Analysis What is technical analysis? Advantages and limitations of technical analysis Different forms of technical analysis Important things to consider while usi...

Preopen Market Stock for 27-09-2019

Today we have preopen market Stock for trading as below:

|

| Preopen Market Stock for 27-09-2019 |

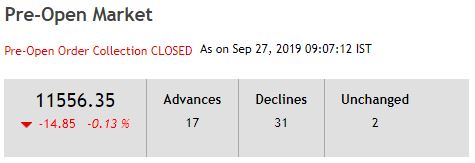

Today when we will see at the level of Nifty in below image for nifty's Trend for today in the morning hours.

Here we can clearly see that

Advanced:Decline:Unchanged Ratio

is showing DOWNTREND due to

17 Advances : 31 Declines : 2 Unchanged Stocks

with -14.85 points and positive 0.13% clear DOWNTREND

|

| Preopen Top 5 Gainers |

1. IOC

2. NTPC

3. INFY

4. HDFCBANK

5. GRASIM

As we see in chart of preopen market top 5 Gainer stocks are 2 having more then 1% change. but even though we can consider the 5 stocks which are still in hold of market and nearly 1% in gain today after sharpe UPMOVE ON MONDAY.

Before making buy positions let market settle for 10 to 15 minutes and then decide the trend of the particular stock as well.

We have found the top 5 loser stocks in preopen market are

1. YESBANK

2. TATAMOTORS

3. ZEEL

4. ULTRACEMO

5. EICHERMOT

We have 5 stocks having near 1% decrease in preopen market. but consider the stock having almost 2% fall in it. so its going to open gap down and it may come up to fill the gap. so risky traders can take buy positions on gap down stock for gap filling and can book their profit.

We are looking for stock with Quantity more 1,00,000.

Today 2 Stocks With Highest Quantity more than 1,00,000.

- TATAMOTORS - 1,17,757

- YESBANK - 9,77,863

Conclusion

Hence for Today's Market i.e. 27th September 2019; we have got total of 10 stocks for the Trading Intraday Trading. And how they performed will be posted in our intraday section.

--------------------

CLICK THIS LINK TO OPEN ACCOUNT WITH ZERODHA

--------------------

FOLLOW ME ON TRADING VIEW :

--------------------

OPEN YOUR ACCOUNT IN TRADINGVIEW :

Subscribe & like and Share : https://goo.gl/7gF1bE

and comment below and click bell icon for regular updates regarding export import and Stock Market recent trends.

Comments

Post a Comment